- Properties

-

- The Mirror Cube

The Mirror Cube

Bariloche, Rio Negro, Argentina

Minimum investment $200

Price Per Share: $1

The Mirror Cube

![]() Live

Live

Bariloche, Rio Negro, Argentina

-

2 Bedrooms

-

1 Bathroom

-

495 Sq Ft

$211,082 Invested in this unit

Unit price: $222,192

- Minimum Investment $200

- Share Price $1

- Maximum Raise $3.233MM

- Target Minimum $456,362

- Raised-to-date $211,082 (7%)

Our investment process

We begin by identifying a market with robust short-term rental potential. In this instance, we have chosen Bariloche, a city located in the Argentine Patagonia region. Bariloche attracts an annual influx of 774,000 tourists, making it the most popular destination in Patagonia and the one of the top 5 most visited in all of Argentina (1).

After identifying the ideal market, we developed a concept specifically tailored to excel on short-term rental platforms like Airbnb and VRBO. We believe that our unique architectural design and unobstructed lake views make our short-term rental units highly attractive to renters.

We will acquire up to 21 condominium units from the developer, with distinct designs. Each unit is displayed separately. Units will be ready to rent on April 2025.

The Patagonia Mirror Hotel

Patagonia Mirror Resort is an elevated travel experience next to the Nahuel Huapi lake, just outside of Bariloche in Argentine Patagonia.

We chose Bariloche as our destination because it attracts visitors year-round. People come here for skiing in the winter, fly fishing in fall and spring, and trekking and water activities in the summer. Bariloche offers an active nightlife scene and renowned cuisine throughout the year.

We've partnered with a variety of architects to craft extraordinary, one-of-a-kind structures, ensuring a truly unparalleled luxury experience.

The Mirror Cube

The Mirror Cube accommodates up to 4 guests and includes 2 bedrooms, a fully equipped kitchen, a living area and one bathroom with a bathtub. These modern modular units feature elevated structures and large windows designed to maximize panoramic views of the lake. Our Mirror cabin never looks the same throughout the day. The reflective panels mirror the changing sky and surrounding forest to blend seamlessly with the natural landscape.

Offering details

We charge 8% sourcing fee (one-time) encompassing our efforts in property sourcing and preparing it for investment. This fee is already included in the Equity Raise from Investors and the share price.

We charge 5% of gross revenues before deducting expenses as asset management fee . This is a quarterly fee paid to Foothold out of the rental income. It helps cover the preparation of tax forms for investors, the distribution of dividends to all investors, procuring insurance policies and filing claims when applicable, ensuring property taxes and loan payments are paid, overseeing financial accounting for properties, and overseeing the third party property manager.

Perks for Investors

New!

New!

Investors in the offering will be eligible for discounts o stays at the property as set out below

50% Discount for three (3) night stay for 2 people

50% Discount for five (5) night stay for 2 people

50% Discount for six (6) night stay for 2 people + 50% OFF o guided fly fishing trip for 2 people

Unit location

The Patagonia Mirror Hotel is situated directly in front of Lake Nahuel Huapi. Our units are conveniently located 12.6 miles from Downtown Bariloche and 10.6 miles from the Cerro Catedral Ski Center. We are adjacent to the Regatas Sailing Club, offering lake access and year-round watersport activities.

How is this market performing?

Data source: Airdna. Learn more about market grades here

Market Score

![]() Learn More about Airdna Scores and Grades here:

here

.

Learn More about Airdna Scores and Grades here:

here

.

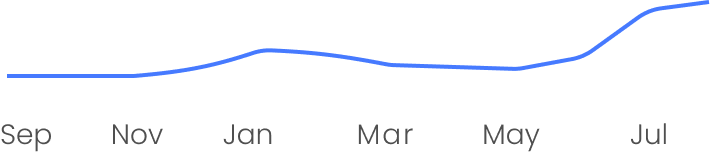

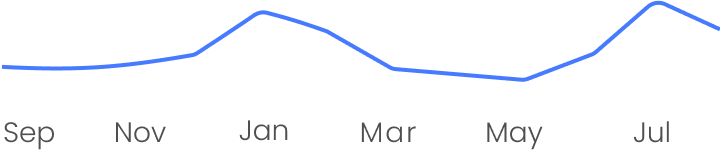

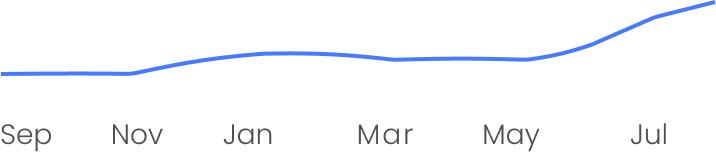

Annual Revenue $21.9K +13% Past Year

Occupancy Rate 62% +13% Past Year

Average Daily Rate$98

Annual Visitors$774K

Top 5 most visited in Argentina 2

Investment Strategy Returns Calculator

Investment Amount

Dividend Yield

Annual Appreciation

IRR

Hypothetical Value after Hold Period

Investment Cashflow Calculator

Property Purchase Price

Average Daily Rate

Occupancy Rate

66%

Operating Costs

40% of revenue

Annual Cashflow

Dividend Yield

About the Patagonia Mirror Hotel

The Perfect Blend Of Nature And Luxury

Mirror Hotel is an elevated travel experience with direct lake views, just outside of Bariloche City, in Argentine Patagonia.

5-Star Comfort And Amenities

We’ve taken everything guests love about glamping and

removed everything you don’t.

Each unit is equipped with a full kitchen, bathroom and HVAC system, and five-star

furnishings.

Patagonia: A Bucket-List Destination

Fly-fishing: during the Fall and Spring seasons.

Skiing Facilities Open: from June to September.

Trekking and Hiiking: All year round.

Patagonian Cuisine: All year round.

Patagonia: Nature's Playground for All Seasons

You can hike through the stunning Andes, hit the slopes for skiing from june to september, or kayak on its pristine lakes in the warmer months. It's a year-round outdoor adventure destination.

Flyfishing Adventures

Fly fishing in Bariloche is best enjoyed in the fall and spring, offering exceptional opportunities to catch trout amidst stunning Patagonian landscapes.

Skiing in Counter-Season

Skiing in Bariloche is at its peak from June to September, with powdery slopes and breathtaking Andean vistas at the world-renowned Cerro Catedral Ski Center.

Frequently asked questions

Crowdfunding allows investors to support new real estate developers or hospitality projects that they are passionate about. With Regulation Crowdfunding Offerings, you aren’t buying products or merch. You are buying a piece of a company or project and helping it grow.

When you purchase shares in a Foothold property offering, you are directly buying ownership in the Series of the LLC that owns a specific property. Our company is a series limited liability company. The purchase of membership interests in a series of our company is an investment only in that particular series and not an investment in our company as a whole.

Investors other than accredited investors are limited in the amounts they are allowed to invest in all Regulation Crowdfunding offerings (on this site and elsewhere) over the course of a 12-month period: If either of an investor’s annual income or net worth is less than $124,000, then the investor’s investment limit $2,500, or 5 percent of the greater of the investor’s annual income or net worth, whichever is greater. If both an investor’s annual income and net worth are $124,000 or higher, then the investor’s limit is 10 percent of the greater of their annual income or net worth, or $124,000 whichever is greater. Accredited investors are not limited in the amount they can invest.

Calculating net worth involves adding up all your assets and subtracting all your liabilities. The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Regulation Crowdfunding Offerings are high risk opportunities and may not retain their value. Investing in real estate crowdfunding is inherently risky and standard company risk factors such as execution and strategy risk are often magnified at the early stages of a company. In the event that a company goes out of business, your ownership interest could lose all value. Furthermore, private investments in real estate crowdfunding are illiquid instruments that typically take up to seven years before an exit via liquidation of the series assets.

Companies conducting a Regulation Crowdfunding are privately held companies, and their shares are not traded on a public stock exchange. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically receive a return on your investment from dividends from the rental income of the properties and from appreciation from the change in property value that will be realized at the end of the investment hold period. In those instances, you receive your pro-rata share of the distributions that occur. In many cases, there will not be any return as a result of business failure. Dalmore Group, LLC does not make investment recommendations, and no communication, through this website or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investments in private placements are speculative and involve a high degree of risk, and those investors who cannot afford to lose their entire investment should not invest. Companies seeking investments tend to be in earlier stages of development, and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Additionally, investors on Regulation Crowdfunding offerings will receive securities that are subject to holding period requirements. In the most sensible investment strategy for investing, real estate crowdfunding should only be part of your overall investment portfolio. Investments in real estate crowdfunding are highly illiquid and those investors who cannot hold an investment for the long term (at least 7 years) should not invest.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold. Exceptions to limitations on selling shares during the one-year lock up are transfers: -to the company that issued the securities; -to an accredited investor; -to a family member (defined as a child, stepchild, grandchild, parent, - stepparent, grandparent, spouse or spousal equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships.); -in connection with your death or divorce or other similar circumstance. After one year, investors may freely sell their shares. Nevertheless, it is important to consider that companies conducting Regulation Crowdfunding are privately held, and their shares are not traded on a public stock exchange. Consequently, these shares cannot be easily traded or sold.

The organization of the company Dalmore Group, LLC requires information that shows the issuer company has taken steps necessary to organize as a corporation or LLC in its state of organization, is in good standing, and that the securities being issued will be duly authorized and validly issued. The corporate structure and ownership Dalmore Group, LLC works with the issuer company to disclose its organizational structure, affiliated entities, and current capitalization. The people behind the company Dalmore Group, LLC helps the issuer company disclose who is behind the operations and strategy of the company, along with their previous related experience, and Bad Actor Reports to provide evidence that the company is not disqualified from proceeding with its offering. Information provided to investors Dalmore Group, LLC checks that the issuer company is providing clear disclosure of its financial situation, business origins, and operations, and legal authority to engage in its business activities. Investor information and terms of the offering Dalmore Group, LLC reviews for consistency each instance where the issuer company describes the offering terms, and identifies to investors how the issuer company reached its current valuation and will track and keep in touch with its security holders. Review of transaction documents Dalmore Group, LLC performs an independent review of transaction documents to check for red flags & conformance with stated terms. Business due diligence Dalmore Group, LLC conducts research and due diligence on each company before it is able to accept investments on the platform. Dalmore Group, LLC will typically conduct over 30-40 hours of due diligence per opportunity, which requires the satisfactory completion of a detailed set of individual questions and data requests. Particular focus is paid to the following issues throughout the due diligence process: Problem or inefficiency being addressed Product / service overview, stage of development and anticipated milestones Demonstrated traction (e.g. revenue, pre-sales, purchase orders, signed contracts, media coverage, awards, etc.) Data to support claims made in marketing materials (e.g. user / customer metrics, signed contracts and agreements, product demonstrations, etc.) Growth strategy Employees and advisors (including ownership structure) Addressable market (e.g. size, growth, penetration, etc.) Competitive landscape and industry dynamics Exit opportunities Intellectual property Historical financials Financial projections(including error-checking, evaluation of key assumptions and reconciliation to stated growth plan) Reference checks (e.g. previous investors, advisors, etc.) Investment overview (including determination of key terms, uses of funds, and current and previous investors) The findings of the foregoing review are presented to Dalmore Group, LLC, which may approve, reject, or require additional information for the offering. Upon approval and following the onboarding process, an offering can begin accepting investments online. General considerations Notwithstanding the foregoing, these investments are illiquid, risky and speculative and you may lose your entire investment. The foregoing summarizes our standard process. However, each diligence review is tailored to the nature of the company, so the aforementioned process is not the same for every issuer. Completing the vetting process does NOT guarantee that the company has no outstanding issues or that problems will not arise in the future. While the foregoing process is designed to identify material issues, there is no guarantee that there will not be errors, omissions, or oversights in the due diligence process or in the work of third-party vendors utilized by Dalmore Group, LLC. Each investor must conduct their own independent review of documentation and perform their own independent due diligence and should ask for any further information required to make an investment decision.

If a company does not reach its minimum funding goal, all funds will be returned to the investors after the closing of their offering.

All available financial information can be found on the offering memorandum.

You may cancel your investment at any time, for any reason until 48 hours prior to a closing occurring. If you have already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please send us an email to investors@foothold.co

If you have questions that have not been answered in the FAQ, please email our Investor Support Team at investors@foothold.co